Liquidity Mining Explained

These are ethdai ethusdc ethusdt and ethwbtc. That is liquidity determines how quickly you can buy or sell an asset at the best possible price with minimal loss.

200 200 Per Year Via Compound Liquidity Mining Yield Farming Listen Notes

200 200 Per Year Via Compound Liquidity Mining Yield Farming Listen Notes

Understanding the liquidity mining mechanism is important to understand what liquidity is and how it works.

Liquidity mining explained. Liquidity mining is being heard about more and more often but few people know about it in detail. The liquidity mining represents a new way for crypto project to distribute tokens. So a dex has no way to determine market prices via these channels.

It will only focus on uniswap v2s four pools. This article contains links to third party websites or other content for information purposes only third party sites. But what is the defi craze of 2020 brought an entirely new way of earning passive income completely redefining the traditional concept of mining.

The third party sites are not under the control of coinmarketcap and coinmarketcap is not responsible for the content of any third party site including without limitation any link contained in a. It needs something else. Liquidity mining is needed because there is no order book there is no matching and no price oracle as these systems are always centralized and vulnerable.

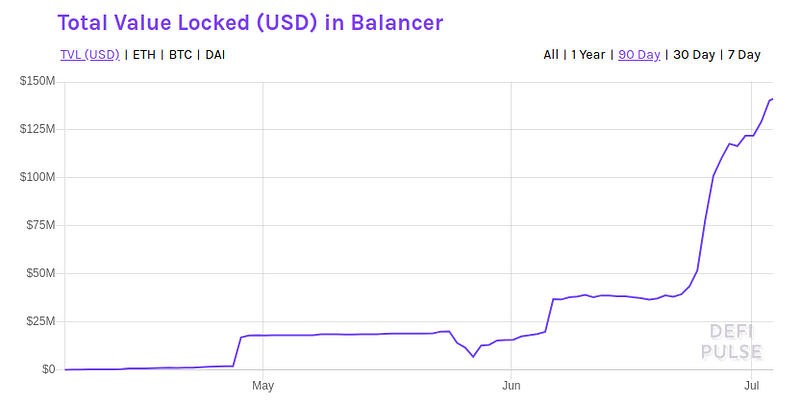

Because larger liquidity pools create less slippage and result in a better trading experience some protocols like balancer started incentivising liquidity providers with extra tokens for supplying liquidity to certain pools. The uniswap team announced in their blog that their initial liquidity mining program will last from 18092020 till 17112020. At first glance you may label it as another copycat following the food token themed protocolshowever the platform utilizes a different formula for rewarding liquidity providers one that enables a more decentralized and sustainable ecosystem.

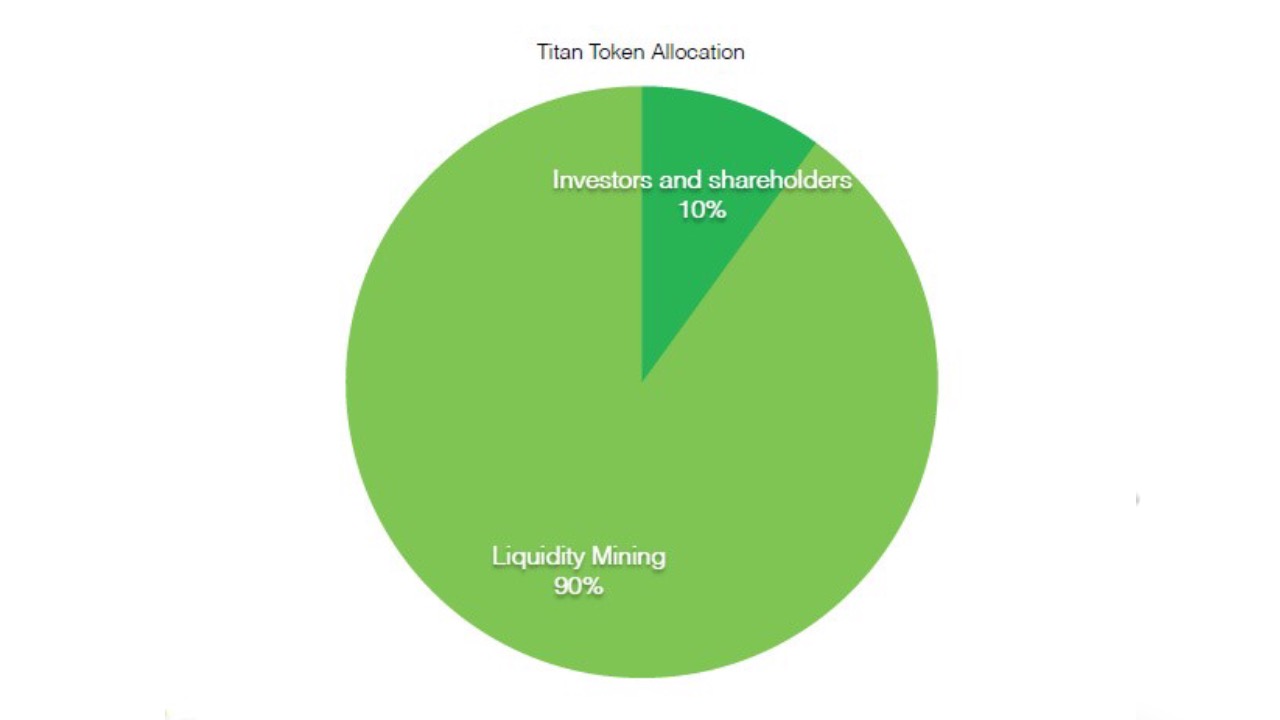

Unlike icos stos and other ieos tokens are not sold to investors. The type of token that gives its holders decision making rights over the projects protocol its product and features. Dego finance is a defi farming platform for liquidity mining where users can deposit assets and earn rewards.

In this video i will explain liquidity mining in a short a. To do this users must take part in the operation of the protocol by providing liquidity to it. What is liquidity mining.

This process is called liquidity mining and we talked about it in our yield farming article. The compound finance credit market was not the first liquidity mining project but it was the one that gave this sector an initial boost with the introduction of their governance token comp. These must be earned.

Liquidity mining otherwise known as yield farming represents a new way of utilizing cryptocurrencies by providing liquidity to decentralized exchanges. Are there any risks when it comes to uniswap. Liquidity is a set of all trading offers with exchanges and brokers.

Balancer Start Liquidity Mining And Earn Bal Tokens Today

Balancer Start Liquidity Mining And Earn Bal Tokens Today

What Is Yield Farming The Rocket Fuel Of Defi Explained Coindesk

What Is Yield Farming The Rocket Fuel Of Defi Explained Coindesk

A Model For The Next Generation Dex Titanswap Will Be A Dex With Better User Experience Press Release Bitcoin News

A Model For The Next Generation Dex Titanswap Will Be A Dex With Better User Experience Press Release Bitcoin News

Yearn Releases Yfi Governance Token With Liquidity Mining Defi Rate

Yearn Releases Yfi Governance Token With Liquidity Mining Defi Rate

Dexs Ride The Defi Wave Liquidity Security And The Road To Mass Adoption Industry Analysis Okex Academy Okex

Dexs Ride The Defi Wave Liquidity Security And The Road To Mass Adoption Industry Analysis Okex Academy Okex

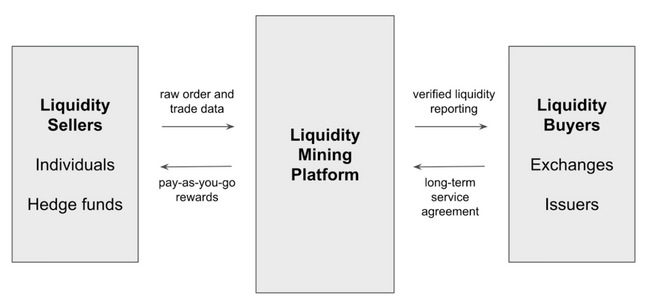

Comparing Liquidity Mining Options In Defi Vs Hummingbot Hummingbot

Comparing Liquidity Mining Options In Defi Vs Hummingbot Hummingbot

Comparing Liquidity Mining Options In Defi Vs Hummingbot Hummingbot

Comparing Liquidity Mining Options In Defi Vs Hummingbot Hummingbot

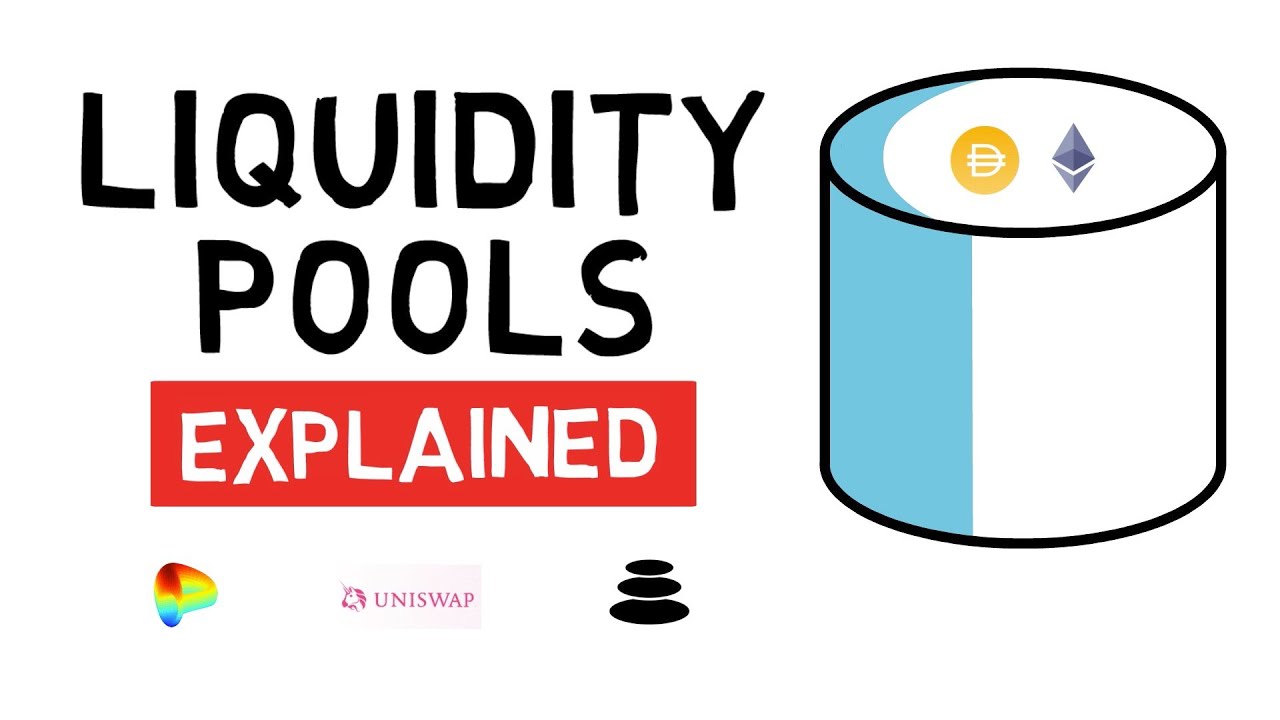

How Do Liquidity Pools Work Defi Explained Finematics

How Do Liquidity Pools Work Defi Explained Finematics

Defi Yield Farming And Liquidity Mining Coincodecap

Defi Yield Farming And Liquidity Mining Coincodecap

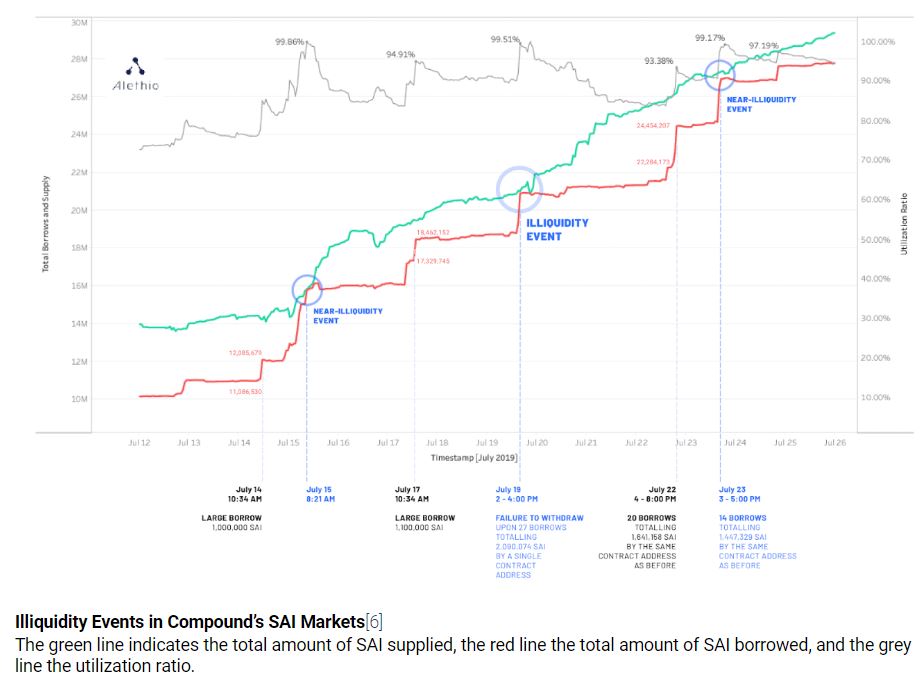

Will Free Lunch Last A Deep Dive Into Defi Liquidity Mining By Iosg Vc Iosg Ventures Medium

Pdf The Analysis Of Mining Company Liquidity Indicators

Pdf The Analysis Of Mining Company Liquidity Indicators

Liquidity Mining With Compound Finance Just A Fad Or The Latest Toolbox After Ieo Icos Coinmarketcap Blog

Liquidity Mining With Compound Finance Just A Fad Or The Latest Toolbox After Ieo Icos Coinmarketcap Blog

New How To Calculate Yield Farming Profits In Defi Liquidity Mining Fastest E Easiest Method Explained

New How To Calculate Yield Farming Profits In Defi Liquidity Mining Fastest E Easiest Method Explained

Impermanent Loss Other Liquidity Mining Risks Explained Dr Julian Hosp The Blockchain Expert

Impermanent Loss Other Liquidity Mining Risks Explained Dr Julian Hosp The Blockchain Expert

Decentralized Exchange Uniswap S Liquidity Mining Rewards Program Ends The Block

Decentralized Exchange Uniswap S Liquidity Mining Rewards Program Ends The Block

How Do Liquidity Pools Work Defi Explained Finematics

How Do Liquidity Pools Work Defi Explained Finematics

Yield Farming And Liquidity Mining From A Regulatory Perspective In Japan Lexology

Yield Farming And Liquidity Mining From A Regulatory Perspective In Japan Lexology

Introducing Liquidity Mining Liquidity Mining Is A Digital By Hummingbot Hummingbot Blog Medium

Introducing Liquidity Mining Liquidity Mining Is A Digital By Hummingbot Hummingbot Blog Medium

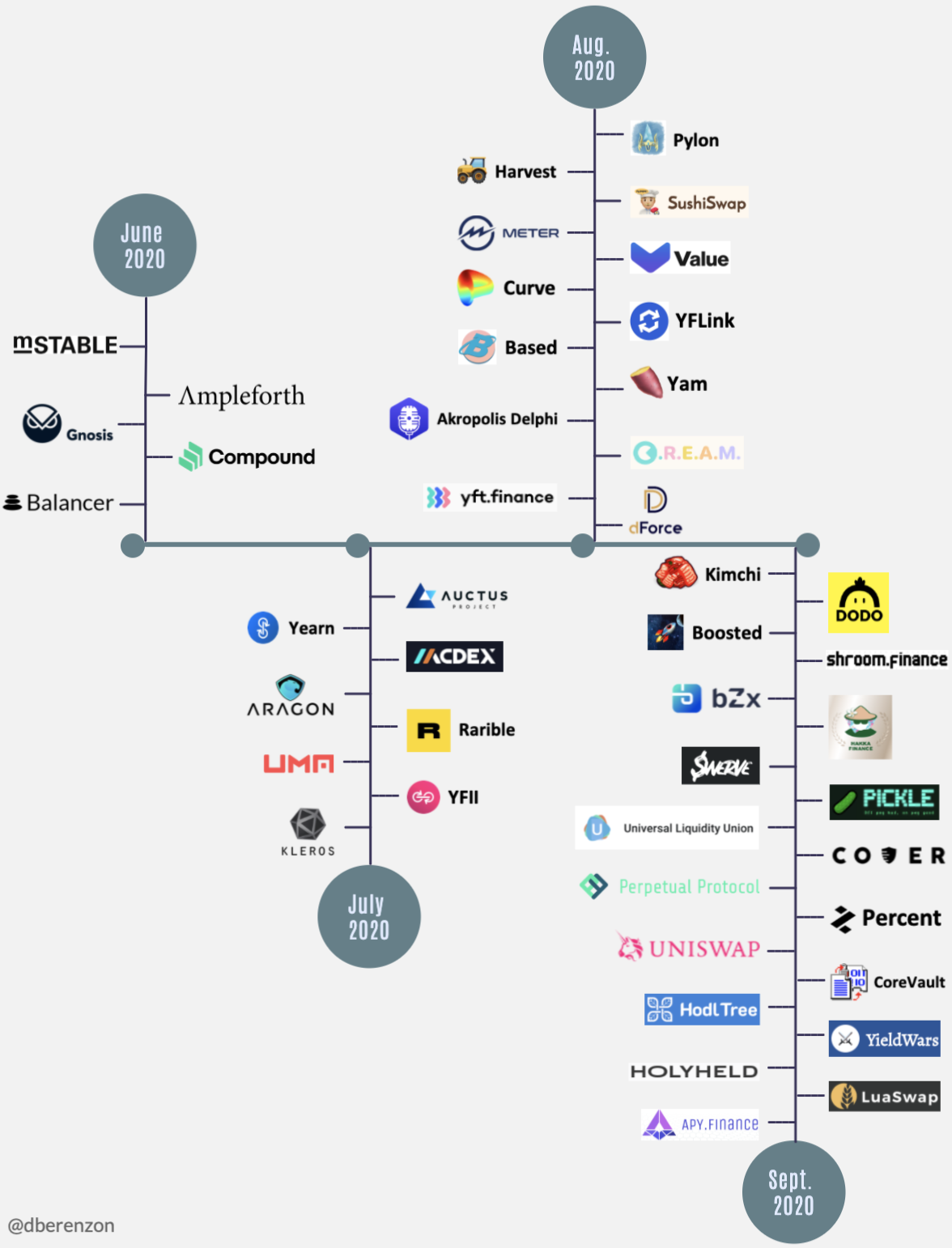

Liquidity Mining A User Centric Token Distribution Strategy By Dmitriy Berenzon Bollinger Investment Group Medium

Liquidity Mining A User Centric Token Distribution Strategy By Dmitriy Berenzon Bollinger Investment Group Medium

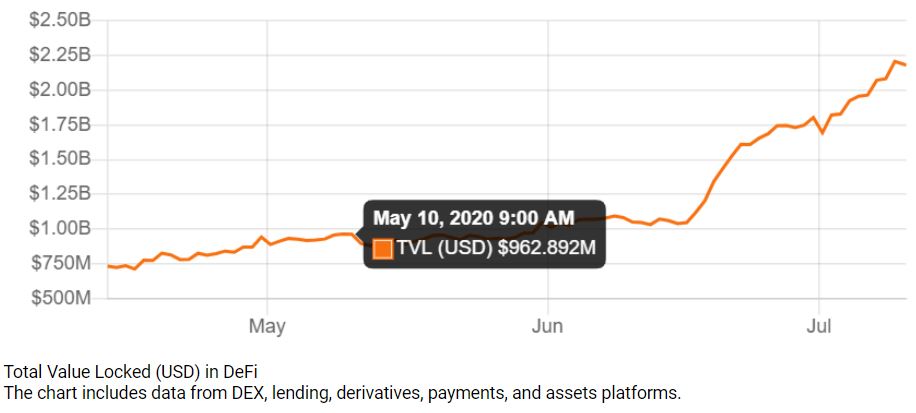

Decentralized Finance And Its Concepts Explained

Decentralized Finance And Its Concepts Explained

Liquidity Mining Is Available Now Walletconnect And Uniswap V2 Youtube

Liquidity Mining Is Available Now Walletconnect And Uniswap V2 Youtube

Comparing Liquidity Mining Options In Defi Vs Hummingbot Hummingbot

Comparing Liquidity Mining Options In Defi Vs Hummingbot Hummingbot

A New Liquidity Mining Program Is Live On Uniswap Utu Pool Is Open Crypto Daily

A New Liquidity Mining Program Is Live On Uniswap Utu Pool Is Open Crypto Daily

Meet Fernando Martinelli Ceo Of Balancer Labs Bal Liquidity Mining

Meet Fernando Martinelli Ceo Of Balancer Labs Bal Liquidity Mining

Hummingbot Liquidity Mining Explained Not Financial Advice Youtube

Hummingbot Liquidity Mining Explained Not Financial Advice Youtube

Liquidity Mining Vs Yield Farming By Gianmarco Guazzo Coinmonks Oct 2020 Medium

Liquidity Mining Vs Yield Farming By Gianmarco Guazzo Coinmonks Oct 2020 Medium

Post a Comment for "Liquidity Mining Explained"